Although most of us receive payslips (or wage slips, as they are also commonly known), many workers still don’t check them properly or are puzzled as to what they mean. It is compulsory in the UK for employees to receive either a digital or paper payslip, but they contain a lot of information which, at first glance, can be inaccessible without knowing exactly what all the payslip codes mean!

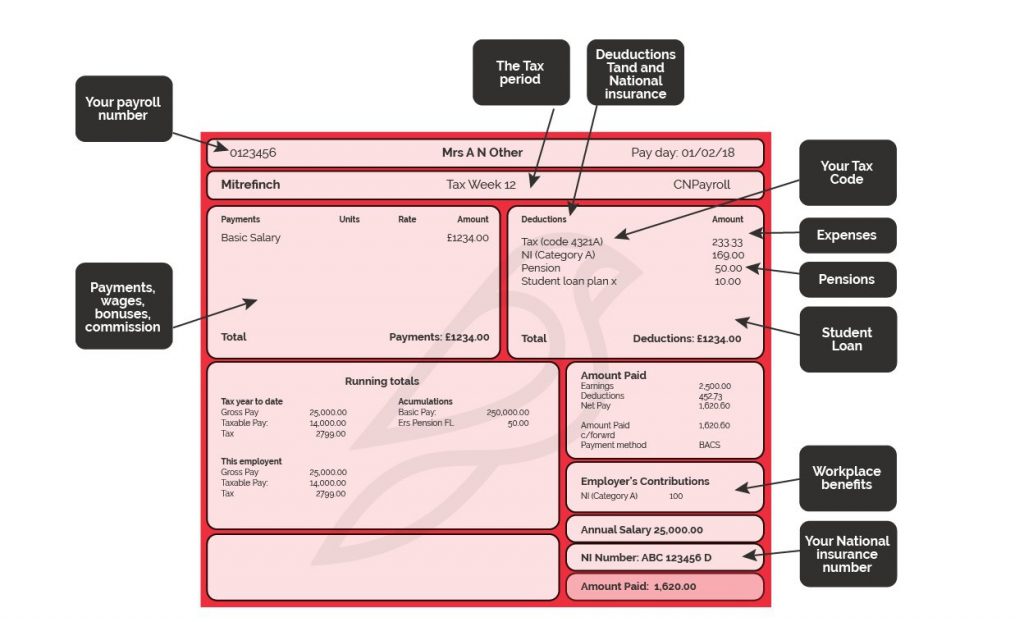

Since most people want to know what is happening with their money (deductions especially!), we’ve put together this handy guide to make it as easy as possible to get to grips with all the details on your payslip. Take a look at the diagram and definitions below to make sure you know how to read your payslip properly.

Payslip explained

A payslip is an official document which is presented to employees each time they are paid. It should show their total wages, payroll number, tax rate and relevant deductions across a set period.

All employees are legally entitled to a wage slip around the time they are paid – be this monthly, weekly or fortnightly. Independent contractors or freelancers are not entitled to a wage slip, but casual staff are. Your wage slip does not necessarily need to be a piece of paper, it is perfectly acceptable, and maybe easier, for it to be sent electronically by email or to be accessible via a secure website.

There are several bits of information that your wage slip must contain and it is advisable to make sure you double check this information on a regular basis so you catch any possible mistakes early.

Payslip example UK

When it comes to reading your payslip, there are few things to get your head around:

Common payslip abbreviations in the UK

Payslips can contain a number of confusing buzzwords and abbreviations. Below we have outlined the most common payslip abbreviations in the UK to help you understand your pay.\

BACS

Stands for: Bankers Automated Clearing Services

What it means: This is how payments are made from one bank account to another

SSP

Stands for: Statutory Sick Pay

What it means: Allowance given to workers who have been unable to work due to sickness for four or more consecutive days

PAYE

Stands for: Pay As You Earn

What it means: A HMRC tax deduction

ET

Stands for: Earnings Threshold

What it means: Earnings before being required to pay tax

PILON

Stands for: Payment in Lieu of Notice

What it means: If an employee has been terminated before their notice, this payment covers the notice period

SMP, SPP, SAP and ShPP

Stands for: Statutory Maternity Pay, Statutory Paternity Pay, Statutory Adoption Pay and Shared Parental Pay

What it means: Various types of parental pay

BA

Stands for: Bereavement Allowance

What it means: Weekly allowance paid out to widows or surviving civil partners

CHB and CTC

Stands for: Child Benefit and Child Tax Credits

What it means: Allowances for parents with children under 16

TY

Stands for: Tax Year

What it means: The annual period in which tax is calculated

What are the details found on a payslip?

Payroll number

Individuals within a company can be allocated payroll numbers as identifiers. Sometimes the payroll number on the payslip will be described as a ‘reference number’.

The tax period

If employees are paid monthly, the tax period can be noted on the payslip. 01 represents April and 12 represents March, to reflect the tax year.

Tax code

The tax code indicates the rate of tax that an employee should be paying, and is represented by a series of numbers followed by a letter. To work out how much income can be earned before tax, add a zero to the numbers in the code. For example, the tax code 1185L means that you will earn £11,850 before paying tax. L is the most common letter in the tax code and shows that tax will be paid at the standard rate.

If an employee recently moved jobs or they’ve started working for a company after being self-employed, they may be put on an emergency tax code. Unfortunately, this may result in them paying more tax than necessary, with any income above the basic personal allowance now being taxed.

You don’t need to worry, as HMRC will automatically update the tax code over time, however you’ll need to be aware that the monthly take-home salary will be impacted by this.

National Insurance (NI) number

To legally work in the UK, an employee must have a National Insurance number that is used to record tax contributions and state benefit entitlements. Most people’s NI category will be Category A, but you can check this on the government website.

Payslip deductions explained

Sometimes your payslip may contain additional deductions for a variety of reasons. It’s essential that a payslip provides both gross pay (pay before any deductions) and the net pay (after deductions).

There are variable deductions which could change on each payslip, such as tax and National Insurance, and fixed deductions, which remain consistent, such as union dues. The employer is not required to list details of fixed deductions if they produce a separate statement with these details each year.

We’ve listed the most common payslip deductions to help you stay aware of potential reductions to gross pay.

Expenses

Any expenses that are owed to the employee or employer via payroll, such as travel costs, can be noted on the payslip.

Student loan

If an employee has taken out a student loan and has begun paying it off, these deductions will be shown.

Pensions

If your workplace has arranged a pension scheme, the amount that an employee is contributing will be on the payslip. As an employer, if you are also contributing to the pension, this may be shown, too.

Workplace benefits

From health insurance to a company car, any workplace benefits will be listed on the payslip and can have an impact on the tax code.

Look after your payslips!

It may be easier to just pop your wage slip in your pocket and forget about it, but it is worth keeping it safe for a number of reasons. The wage slip obviously details a lot of personal information that could be used for identify fraud so don’t let it fall into the wrong hands. They also give evidence of your earnings which may be needed if, for instance, you apply for a mortgage as the lender often asks for the last three payslips as proof of income! If you get your payslips emailed to you, make sure to save a copy for your future reference!

Frequently Asked Questions

Should all employees receive a payslip?

It is a legal requirement for employers to provide employees with a payslip and, furthermore, payslips need to detail the number of hours worked and paid for.

Only contractors and freelancers would be exempt, as they are not classified as an ‘official’ employee.

When should payslips be made available to employees?

Employers are legally required to provide employees with a payslip on or before payday, whether that’s a paper or electronic version.

What happens if my employees are confused about their payslip?

It can be a lot of information to take in, so encourage your employees to speak to the HR or Payroll departments if they have any queries. If you’re finding yourself dedicating too much precious time to managing your payroll, it might be time to look at implementing a payroll solution to streamline the process.

Do you pay much attention to your payslips? Let us know on Twitter or LinkedIn.

Looking for a capable and effective payroll software? Why not get in touch today and see how Mitrefinch UK can help you.